January 2026

- The United States continues active enforcement of existing sanctions on Venezuelan crude oil exports.

- Enforcement includes legal detention, seizure, and monitoring of sanctioned oil tankers, supported by U.S. Navy and Coast Guard assets.

- U.S. officials describe current actions as sanctions enforcement, not a formally declared naval blockade.

Market Status

- Brent crude trading around USD 60–61/bbl.

- WTI trading around USD 57–58/bbl.

- No immediate global supply shock observed.

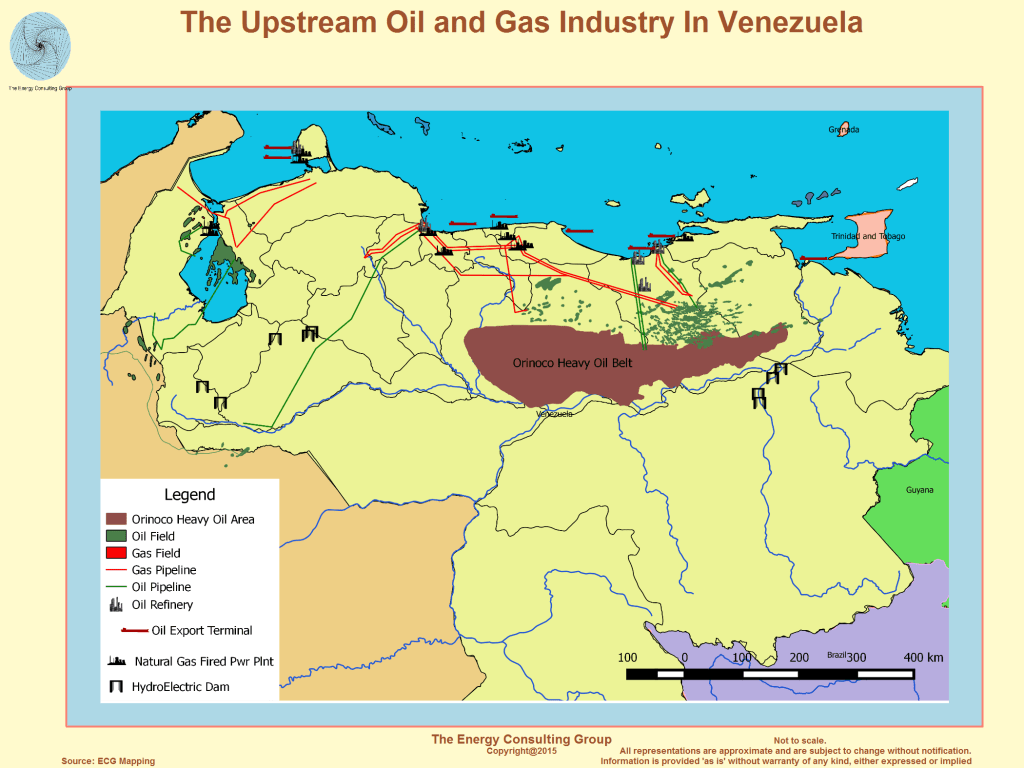

Production

- Venezuela producing ~1 million bpd or less, representing <1% of global supply.

Shipping

- Multiple tankers reported departing Venezuelan ports under AIS-restricted (“dark shipping”) conditions.

- Several sanctioned vessels detained or intercepted under existing legal authorities.

- Legitimate exports to Asia slowed or halted.

Regional Exposure

- China remains the most exposed buyer.

- India had already reduced Venezuelan imports significantly prior to 2026.

- U.S. Gulf Coast refineries remain technically suited for Venezuelan heavy crude but constrained by sanctions.

Verification

- No officially declared maritime blockade announced.

- No confirmed new oil supply disruption impacting global markets as of early January 2026.

Leave a comment